Goals tracking

Partner with our ESG reporting experts who will assist you in identifying pertinent ESG metrics and crafting your comprehensive ESG report.

The call for consistent, comparable, and transparent climate, environmental, social, and corporate governance information stems from the expectations of investors, stakeholders, employees, and regulators within the EU economic area.

Stay informed about key corporate reporting regulations, including:

1. CSRD: Corporate Sustainability Reporting Directive:

new reporting rules for multinationals adopted by EU Parliament on November 10th 2022

2. TCFD guidelines

Climate-related issues developed by the Task Force on Climat-related Financial Disclosures, a group established by the Financial Sustainability Board.

3. EU taxonomy

Regulation 2020/852 on establishing a framework to facilitate sustainable investment,

4. SFDR Regulation

Sustainable Finance Disclosure Regulation. Regulation 2019/2088 of the European Parliament and of the Council (EU) on the facilitation of information related to sustainability in the financial services sector.

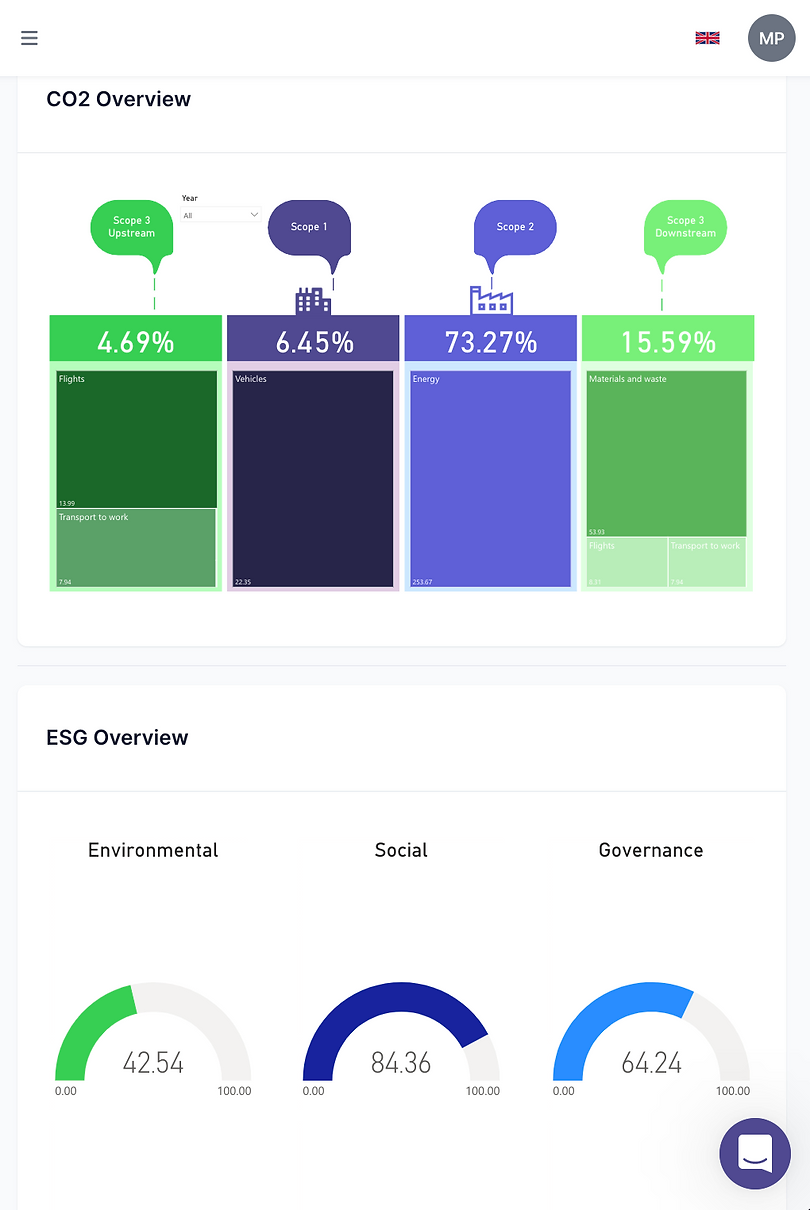

We consult how to define and implement an ESG disclosure index, which companies use as a legitimacy tool that external stakeholders use to reliably measure and compare the ESG performance of companies.

ESG Institute offers implementation methodology based on 5 steps:

1. Conducting a materiality assessment and establishing the baseline

2. Setting ESG goals

3. Analyzing performance gaps

4. Creating and implementing ESG plan and KPIs according to EU Directive

5. Preparing principles for regular ESG reporting.

Contact us to explore partnership opportunities and showcase your ESG tools, methodologies, or solutions on our platform.